Whether you are a homeowner, condo owner, or a renter, your insurance has personal property coverage. On a homeowner’s policy, it tends to be much more than on a renters policy. If you are a homeowner, you may have more than $100,000 of personal property coverage, which provides coverage for the items you can take with you (i.e. couches, beds, TV’s, tables, etc).

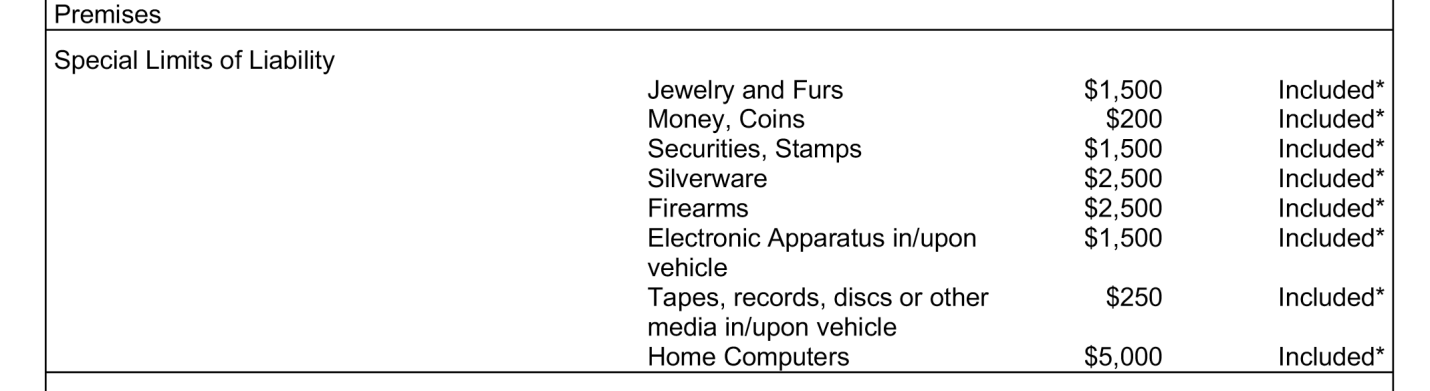

Many clients we speak with think that since they have $100,000 of personal property, that means everything they have in their home is covered in the event of a loss. Well, they are somewhat correct. Insurance companies understand that people have certain items which tend to be very expensive to replace, for example a wedding ring, firearm, or collection. Therefore, the insurance companies have set certain limits to your personal property. Here is an example of a homeowners declaration page that shows the very specific limits covered on the policy:

Most homeowners insurance policies have a jewelry limit of $1,500, some may have up to $3,000. With the average price of an engagement ring at $5,978*, a homeowners policy will most likely not cover the ring in the event of a loss. So how do you make sure your items are properly covered?

There are 2 ways you can insure your personal property item(s):

- Schedule the item(s) on your homeowners policy. Insurance companies will allow a ring or other item to be scheduled at the current appraised value; keep in mind, the item is still subject to the homeowners deductible

- Obtain a separate personal articles policy for the item. There are policies that specifically insure the item(s), and most of them have a very low deductible, if none at all

How are you properly protecting your personal property?

*https://www.bustle.com/articles/144926-this-is-the-average-cost-of-an-engagement-ring